By Donald Zuhn –-

Last week, the U.S. Patent and Trademark Office released its FY 2018 Performance and Accountability Report. In describing the USPTO's strategic and performance-planning framework, the 2018 Report notes that the Office issued its 2014-2018 Strategic Plan in 2014, and that the Plan "demonstrates the progress made to date by building on the tangible successes of recent years with a focus on achieving the USPTO's vision as a global IP leader by:

• Establishing progress toward optimal pendency and quality levels for both patents and trademarks that will enable the USPTO to operate efficiently and effectively within the expectations of the IP community;

• Administering effectively the provisions of the AIA;

• Continuing to transform the USPTO with next-generation technology and services;

• Maintaining a strong and diverse leadership team, agile management structure, and a diverse and engaged cadre of employees in achieving the agency's mission and vision;

• Continuing to work with other government agencies, Congress, and the USPTO's global partners to establish IP systems that benefit innovation, create jobs, and lead to strong economies around the world; and

• Recruiting and retaining the highest quality employees to accomplish the agency's important work."

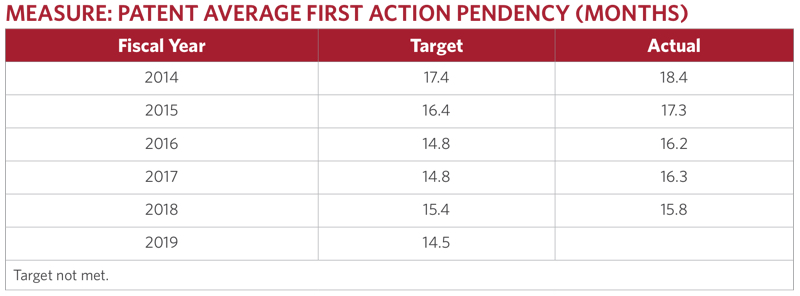

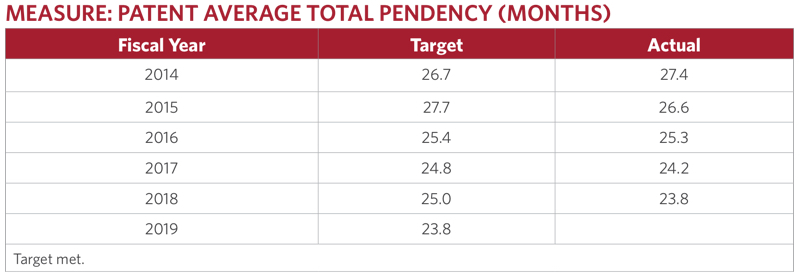

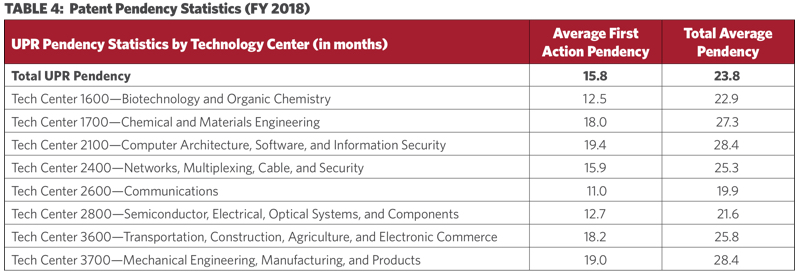

The 2018 Report specifies ten key performance outcome measures for which the Office has developed annual performance targets. According to the Report, the Office exceeded its annual performance targets for nine of the ten performance measures. Two of the ten measures fall within the Office's first strategic goal, which concerns optimizing patent quality and timeliness. In particular, average first action pendency was 15.8 months (higher than the 15.4-month target, but lower than the 16.3-month average first action pendency of FY 2017), and average total pendency was 23.8 months (lower than the 25.0-month target and lower than the 24.2-month average total pendency of FY 2017).

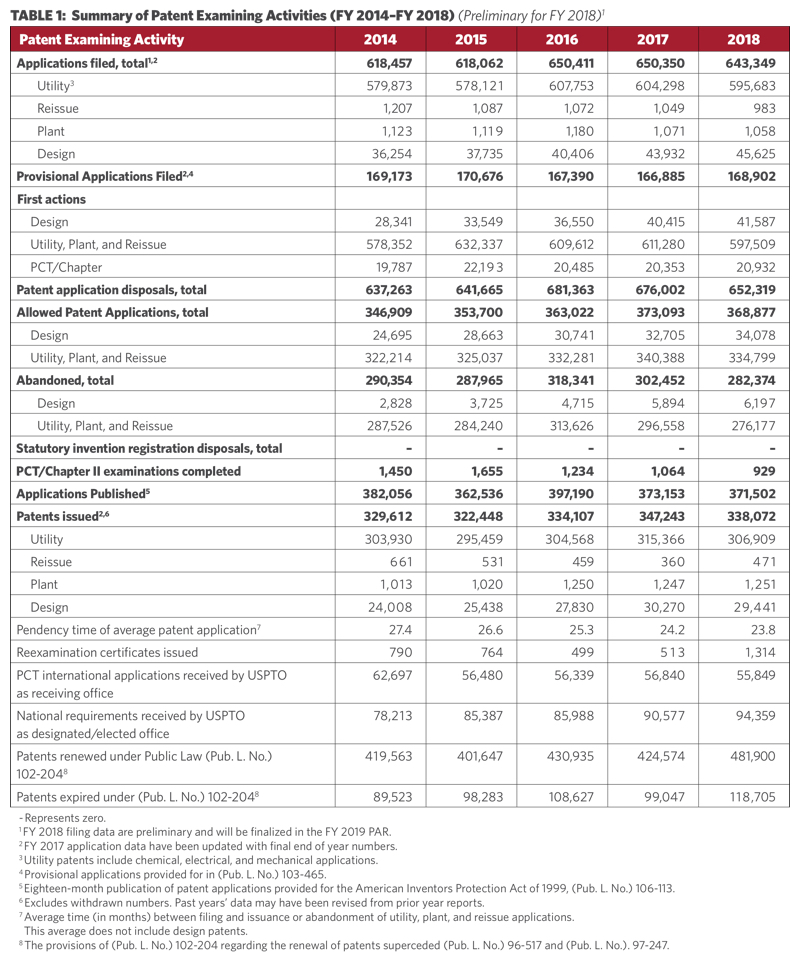

Table 3 of the Report provides data for the patent-related performance targets for FY 2014 to FY 2018 (click on any table to expand):

The Report also notes that the number of applications filed decreased from 650,350 in FY 2017 to 643,349 in FY 2018, which constituted a 1.1% decrease in filings (see Table 1 below). This followed a very slight decrease in application filings in FY 2017 and a 5.2% increase in application filings in FY 2016.

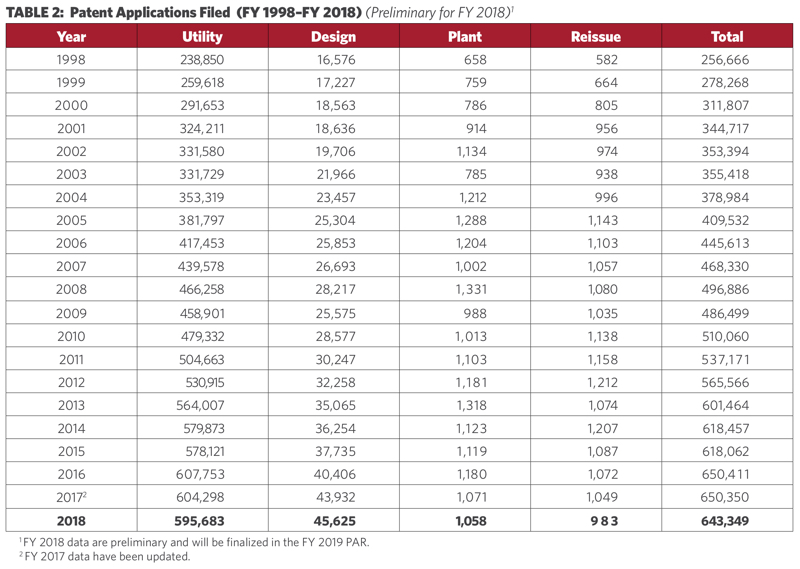

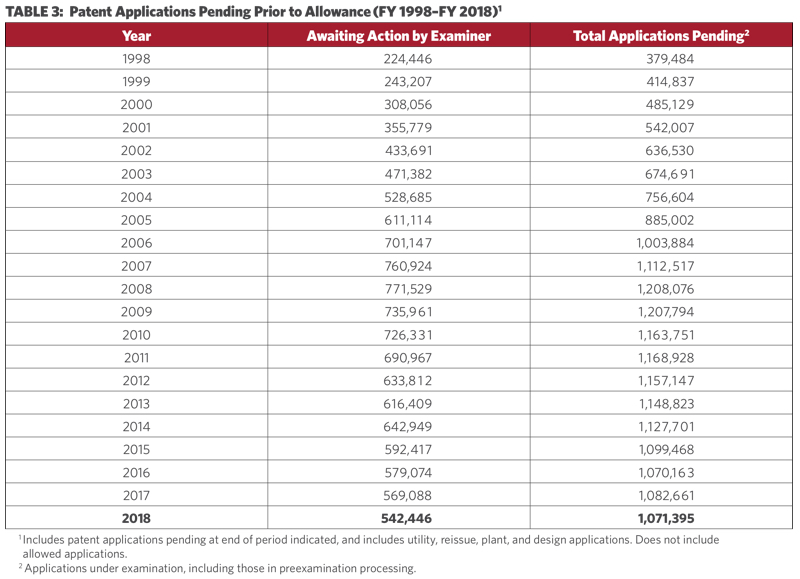

The Report also indicates that while the Office accepted more than 600,000 patent applications for the sixth straight year and topped 500,000 applications for the ninth consecutive year (see Table 2 below), it was able to reduce the number of applications awaiting action from 569,088 in FY 2017 to 542,446 in FY 2018 (see Table 3 below). The total number of pending applications also decreased from 1,082,661 in FY 2017 to 1,071,395 in FY 2018. It was the Office's fourth consecutive reduction in number of applications awaiting action, but first drop in total number of pending applications since the Office's streak of consecutive reductions in total number of pending applications was snapped at five in FY 2017.

After increasing from 304,568 utility patent issuances in FY 2016 to 315,366 in FY 2017, patent issuances once again dropped in FY 2018, falling to 306,909 (see Table 6 below).

As noted above, the results for first action and total pendency were mixed, with first action pendency coming in above the Office's target, and total pendency coming in below the Office's target (see Tables 4 and 5 below). And as usual, the goals for the current fiscal year present even tougher challenges: for first action pendency, the annual performance target drops from 15.4 months for FY 2018 (which the Office failed to meet) to 14.5 months for FY 2019, and for total pendency, the annual performance target drops from 25.0 months in FY 2018 (which the Office met) to 23.8 months in FY 2019.

When comparing pendency statistics by Technology Center, Tech Center 2600 (communications) produced the best average first action pendency (11.0 months), with Tech Center 1600 (biotechnology and organic chemistry) following in second (12.5 months), and Tech Center 2100 (computer architecture, software, and information security) produced the worst average first action pendency (19.4 months) (see Table 4 below). As for total average pendency, Tech Center 2600 also produced the best total average pendency (19.9 months), with Tech Center 2800 (semiconductor, electrical, optical systems, and components) following in second (21.6 months), and Tech Center 3700 (mechanical engineering, manufacturing, and products) and Tech Center 2100 (computer architecture, software, and information security) producing the worst total average pendency (28.4 months).

For additional information regarding this and other related topics, please see:

• "USPTO Releases Performance and Accountability Report for FY 2016," February 6, 2017

• "USPTO Issues Performance and Accountability Report for FY 2015," March 3, 2016

• "USPTO Issues Performance and Accountability Report for FY 2014," April 7, 2015

• "USPTO Releases Performance and Accountability Report for FY 2013," January 9, 2014

• "USPTO Releases Performance and Accountability Report for FY 2012," November 28, 2012

• "USPTO Releases Performance and Accountability Report for FY 2011," November 30, 2011

• "USPTO Releases 2010 Performance and Accountability Report," November 17, 2010

• "USPTO Announces 'Highest Performance Levels in Agency's History' in 2008," November 18, 2008

• "USPTO Announces 'Record Breaking' 2007 Performance," November 15, 2007

• "Patent Office Announces Record-Breaking Year," December 27, 2006

Leave a comment