By Donald Zuhn —

Last week, the National

Last week, the National

Venture Capital Association (NVCA), a trade association representing the U.S.

venture capital industry, released the results of its MoneyTree Report on venture

funding for the second quarter of 2013.

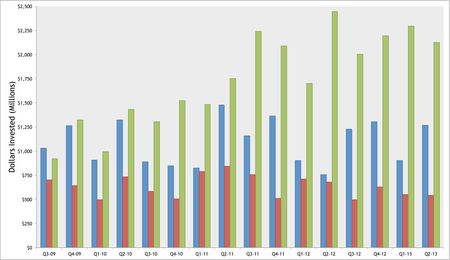

The report, which is prepared by NVCA and PriceWaterhouseCoopers LLP

using data from Thomson Reuters, indicates that venture capitalists invested

$6.7 billion in 913 deals in the second quarter, which constituted a 12%

increase in dollars and a 2% increase in deals as compared with the first

quarter, when $6.0 billion was invested in 896 deals (see chart below, which shows total venture funding from the second

quarter of 2009, when the Great Recession ended

through the second quarter of 2013; data from MoneyTree Reports; click on chart to expand).

Venture Funding – Q2 2009 to Q2 2013

The biotechnology sector rebounded

The biotechnology sector rebounded

in the second quarter to place second behind the software sector, with funding

increasing by 41% to $1.3 billion and the number of deals rising by 2% to

103. The software sector once again took

the top spot in funding — with $2.1 billion invested — marking the fifth

straight quarter in which the software sector topped the $2 billion funding

level (see chart below, which shows venture funding for the biotech (blue), medicial devices (red), and software (green) sectors since the third quarter of 2009, which was the last quarter in which the biotech sector outpaced the software industry; data from MoneyTree Reports; click on chart to expand). Medical Device investment dropped

by 1% with respect to both dollars and deals, with $543 million being invested

in 71 deals. Overall, eight of the

seventeen sectors tracked by the NVCA saw decreases in dollars invested in the

second quarter.

Venture Funding by Industry – Q3 2009 to Q2 2013

Biotechnology funding =

Biotechnology funding =

blue; Medical devices

= red; Software = green

With respect to the second

With respect to the second

quarter results, NVCA president Mark Heesen observed that "[i]n many ways

it feels like the late 1990's with information technology driving venture investment

and significantly outpacing other sectors when it comes to level of activity

and momentum." He also noted that "[l]ife

sciences investment is poised for a slow and steady recovery, provided we can

continue to see progress on the regulatory front."

For additional information regarding this and other related topics, please see:

• "Biotech Venture Funding Down 33% in First Quarter," April 30, 2013

• "Annual Venture Funding Drops for First Time in Three Years," February 4, 2013

• "Biotech Venture Funding Up 64% in Third Quarter," October 29, 2012

• "Venture Funding in Life Sciences Sector Drops 9% in Second Quarter," July 22, 2012

• "Biotech Venture Funding Drops 43% in First Quarter," May 3, 2012

• "Venture Funding Increased 22% in 2011," February 2, 2012

• "Life Sciences Venture Funding Drops in Third Quarter," October 27, 2011

• "Life Sciences Venture Funding up 37% in Second Quarter," August 1, 2011

• "VentureSource Reports 35% Increase in 1Q Venture Funding," April 26, 2011

• "NVCA Reports Modest Gains in First Quarter Venture Funding," April 19, 2011

• "NVCA Reports 31% Drop in Venture Funding for Third Quarter," October 17, 2010

• "NVCA Reports 34% Increase in Venture Funding for Second Quarter," July 22, 2010

• "NVCA Report Shows First Quarter Drop in Venture Funding," April 20, 2010

• "Biotech/Pharma Financing Improving, R&D Spending Up," August 31, 2009

• "NVCA Study Shows Increase in Third Quarter Venture Funding," October 23, 2009

• "First Quarter Venture Capital Funding at 12-Year Low," April 23, 2009

• "NVCA Study Shows Decline in 2008 Investment; BIO Study Predicts Biotech Rebound in 2009," February 16, 2009

Leave a comment